Reich, Robert B. Saving Capitalism: For the Many, Not the Few, Alfred A. Knopf, New York, 2015 (279pp.$26.95)

Though politicians seeking to cash in on the slogans and shibboleths surrounding immigration, abortion, and militant nationalism often obfuscate our country’s ills, the reality is otherwise. For three decades after World War II, the average hourly compensation of American workers rose in proportion to gains in productivity. The middle class expanded. Beginning, however, in the 1970’s, this virtuous cycle ended. Median household income dropped when adjusted to inflation, then dropped precipitously during the crash of 2007 and never recovered. The median wage of young college graduates stopped growing while student debt skyrocketed. The richest four hundred Americans have more wealth than the bottom 50% of Americans and the wealthiest 1% own 42% of private assets. Since 2000, the weekly earnings of full-time wage and salary earners at the median have dropped until they are lower than they were forty years ago. The ranks of the working poor have exploded. Ninety percent of all Americans are getting poorer day by day, while rich families are becoming an in-grained aristocracy. Cliques of Wall Street Banks, K-Street lobbyists, billionaire capitalists, hedge-fund managers, monopolistic corporations and a Supreme Court majority that equates money with speech, have jury-rigged Democracy, destroying what little was left of the American system of electoral politics. The people are mostly sleepwalking screen Zombies staring at NFL games while devouring order-out pizza chased by diabetes medication.

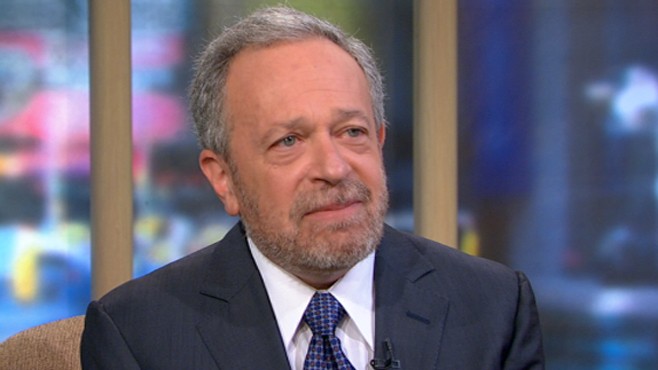

Robert Reich addresses these issues and more in his new book, “Saving Capitalism: For the Many, Not the Few”. Formerly a Secretary of the Treasury in the Clinton Administration, Reich now teaches at the University of California, Berkeley, where he is Chancellor’s Professor of Public Policy and senior fellow at the Blum Center for Developing Economies. His fourteen previous books include the bestseller “Supercapitalism” and “Locked in the Cabinet”. As a democrat, public intellectual, and prominent economic authority, Reich has long advocated changing the rules of capitalism to “un-rig” the game that is now played in favor of the rich–wealthy families, super-elites on Wall Street, and their corporate allies and cronies. More than ever, Reich preaches that the problem of wealth and income inequality is destroying people’s trust, dividing communities and social groups, and leading to less democracy and more ennui and disengagement.

“Saving Capitalism” is both a clear-eyed analysis of how our country came to be so unequal, and also a clarion-call to action. Its arguments are cogent, compelling and easy to understand, forming fast-paced ride down sixty years of economic and political history to a place where the so-called American dream of upward mobility, education as salvation, work as valuable, and sharing the wealth ends in the Dead End of plutocracy and despair. We’ve reached a place where rich men like Mitt Romney who’ve inherited their money (his own children never need work a day in their lives) sneer at the 50% who don’t make enough money to pay Federal income tax.

Reich’s premise is simple. We’ve been sold a bill of goods in the standard narrative: We’ve been told by the rich and powerful that our choices lay between the “free-market and smaller government” and socialism. We’ve been told that everybody makes what they’re “worth” (the Meritocracy shibboleth), even CEOs and Bank Managers who drive the economy into a ditch. We’ve been told that raising the minimum wage will kill jobs and that the sole responsibility of corporations is to their shareholders.

Reich’s book sets out what we haven’t been told. We haven’t been told how the rules of property, contract, monopoly (anti-trust), bankruptcy law and enforcement procedures further the interests of the wealthy and powerful in a consistent and all-pervasive way. We haven’t been told how the “revolving door” between government, regulatory agencies and large lobbying firms in Washington prevent reform, and we haven’t been told how vast sums of money now skew the political process, allowing those at the top to prosper at the expense of everybody else. Living in a dream world where we’re told that all our problems will disappear if we just trust the magic of the “free market”, we race to the Bottom.

Reich harkens back to the “Golden Days” of American capitalism, where everybody—workers, professionals, party politicians and elected officials all had skin in the game. From the 1930s through the 1970s, small local social groups (think: PTA), labor unions, local banking associations (they’re all gone), regional business representatives (devoured by lobbyists in Washington and destroyed by monopoly) and independent Federal regulatory agencies maintained a “countervailing” power against the natural tendency of rich capitalists to concentrate against the people. These days, the countervailing power is absent. The Glass-Steagle Act of 1933 that separated commercial from investment banking was abandoned by the Clinton Administration, setting the stage for agglomerations of wealth accompanied by huge risk. Big Oil, Big Pharma, Big Agriculture, Big Google and Big Amazon dominate the economy.

Reich writes, “Moneyed interests do not want the curtain of the “free market” lifted because that would expose their influence over the rules of the capitalist game (governing property, contract, monopoly, freedom to associate and enforcement) and reveal potential alliances that could countervail that power. And what would today’s countervailing power look like? It would reverse Citizen’s United, the Supreme Court’s decision granting big money sway over all our elections. It would close the revolving door between government and business. It would apply anti-trust law and break up the five big Wall Street banks. It would insist that so-called “Free Trade” agreements include both wage and environmental protections. It would reform franchise laws and contracts, raise the minimum wage, restrict CEO pay and uncouple it with stock options and transfers, limit patents and trademarks to shorter periods, and re-formulate educational funding laws so that poor districts would no longer receive less per-pupil than wealthier school districts. It might include the forming of a third party.

These are weighty matters and Reich is less than persuasive in his argument that a countervailing power can come into play against the leverage of the rich, and how it might do so. After all, it is they who plunder the poor, slow and legal.